The international benchmark for crude oil price, Brent Crude, is down 59% from three years ago. Oil prices in the $50-60 per barrel range is the new reality. The Organization of the Petroleum Exporting Countries failed to increase the price of oil in late May, despite capping oil production. These are just some of the hard truths now facing those in the oil and gas sector.

Industry Develops Laser Focus on Revenue, Cost-Cutting

While this slump in oil company profits might initially seem detrimental, the new “normal” in crude prices has forced those in the oil industry to get thrifty with expenditures. Oil companies are focusing on ventures that are more profitable, and spending less time pursuing costly endeavors like drilling in the Arctic. Producers are cutting costs wherever possible.

This focus on cost-cutting and revenue-positive ventures has helped to ease the concerns of worried investors and has allowed oil companies to start funding new ventures again. According to Daniel Yergin, vice chairman of IHS Markit, “lower for longer has become the new mantra in the industry.”

Revolutionary Systems for Higher Efficiency

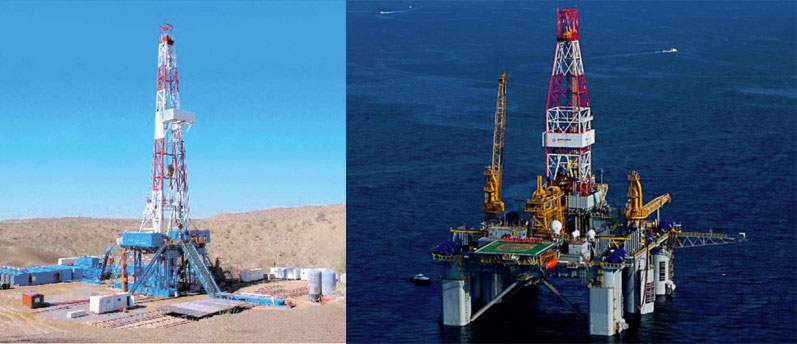

With oil prices stabilizing lower than expected, the solutions offered by Sigma Drilling Technologies are key to allowing drilling contractors to thrive. As the leading pulsation solutions provider and dampener manufacturer, Sigma is at the forefront of technology, offering products that help drilling rigs run more efficiently and save money in the process. Drilling contractors can still make the latest technological advances available to their teams, without sacrificing cost efficiency.

If helping your drilling business run more efficiently sounds appealing, contact the Sigma Drilling Technologies team at 281-656-9298 to request a free demonstration. We’ll help you discover the efficiencies that can be gained with better pulsation control equipment, which will help your company save money and improve performance. Thrifty doesn’t have to mean lower quality – Sigma Drilling Technologies is proof of that.